This post may contain affiliate links. Please see my disclosure policy for more details.

If you’re planning on moving overseas and need to move your savings over, you’re probably wondering how to transfer money abroad cheaply.

As an expat, I’ve often had to transfer money to Australia from the UK. After a lot of research, I decided that the best way to send money overseas was to use online currency specialist Wise (formerly TransferWise). This worked out much cheaper than using banks, which tend to charge large fees and use poor exchange rates.

Whether you’re moving to a new country and need to move a substantial sum or you’re simply travelling or doing a working holiday in Australia, read on to find out why you should consider using a specialist currency exchange company to transfer money abroad cheaply.

How to Transfer Money Abroad Cheaply: Contents

To make an informed decision on the best way to transfer money overseas, it’s important to understand the basics of how exchange rates work and how currency specialists work compared to banks.

This post explains foreign exchange and how Wise works. Click on any of the topics below to skip to a section and learn more.

- 1. Buy and Sell Rates vs Mid-Market Rate

- 2. How Wise Started

- 3. How Wise Works

- 4. How Do I Get a Wise Quote?

- 5. How Do I Transfer Money Abroad with Wise?

1. Buy and Sell Rates vs the Mid-Market Rate

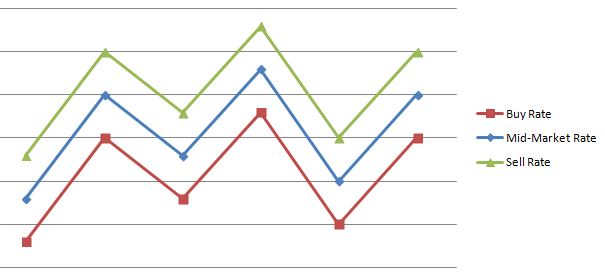

If you’ve ever used your local currency exchange service inside a bank or travel agency, you’ve probably noticed that each foreign currency available has two different rates advertised: a buy rate and a sell rate.

If you were going on holiday to Australia from the UK, the trader would sell you Aussie dollars at the sell rate. But if you were returning from your holiday, the trader would buy your leftover dollars back at the buy rate, and you’d get back less than you would have paid for them on that day.

If you go onto Google, XE or Yahoo Finance however, and look up the exchange rate between two currencies, you’ll only be shown a single rate, which lies somewhere in between the buy and sell rates that currency traders offer.

This is what’s known as the mid-market rate, or inter-bank rate, as it’s the rate banks usually use when trading currency between themselves.

So even if a currency trader advertises that they charge no commission, which they often do, they’re simply making a profit by marking up the real exchange rates to buy and sell rates instead. The same goes when you’re transferring money abroad as well as changing cash.

Obviously the trader needs to make a profit, as they’re running a business, but the problem with charging no commission and hiding the fees inside exchange rates is that it’s unclear how much extra you’re actually paying them.

2. The Wise Story: Two Estonians Meet at a Party

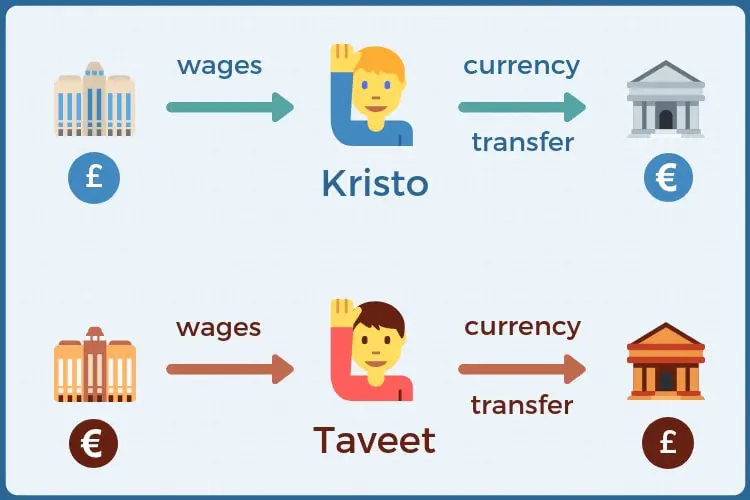

The story of Wise began when two Estonian guys, Kristo and Taavet, met at a party whilst living in London.

It turned out that Taavet was being paid in Euros, but needed to pay his UK bills in British pounds. Kristo was being paid in pounds, but needed to pay his Estonian mortgage in Euros.

Both men were losing money every month by exchanging currency in opposite directions using buy and sell rates.

They realised that if Taavet transferred the Euros he earnt into Kristo’s Estonian account, and Kristo transferred the corresponding pounds he earnt into Taavet’s British account, they could simply both use the mid-market rate and save money!

They realised how many other people could save money by doing the same thing, and so the idea of Wise was born!

3. How Wise Works

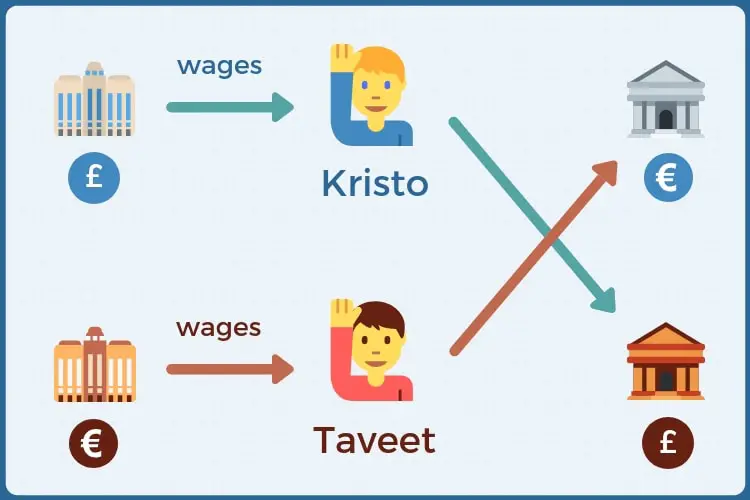

Wise has bank accounts set up in over 50 countries. When I want to transfer money to Australia from the UK, I simply transfer the desired amount from my UK bank account to Wise’s UK bank account.

Wise then pays the corresponding amount, calculated using the mid-market exchange rate plus a small commission, into my Australian bank account from their own Australian bank account. So no international money transfer actually takes place.

The money I pay into their UK account will go towards funding payments to other people who want to transfer money from foreign currencies into British pounds. The money I receive in Australia will have been funded by people who want to change money from Australian dollars into other currencies, and have paid into Wise’s Australian bank account.

So it’s just like the Kristo and Taavet exchange but on a much larger scale, with over a billion dollars from over a million customers going in and out of Wise’s worldwide accounts every month!

The idea was so brilliant that the company was invested in by Richard Branson and the two founders of Paypal!

4. How Do I Get a Wise Quote?

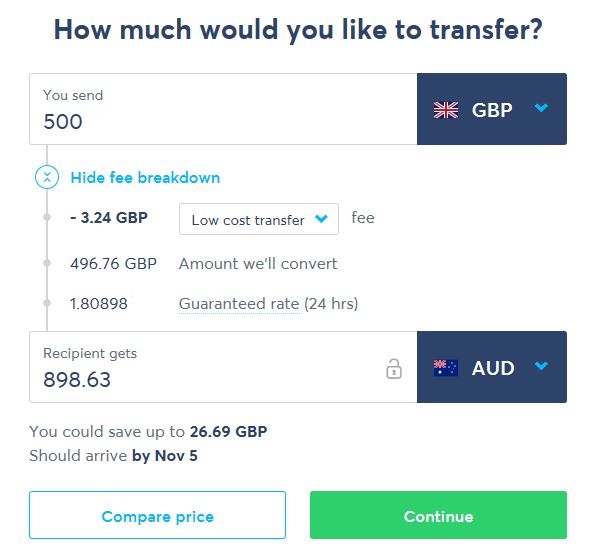

One of the reasons I chose to use Wise is their transparency. Anyone can go onto their home page, plug in the currency they want and get an instant quote, with both the rate and the fee breakdown shown.

You’ll see they use the mid-market rates and add on a small, fully disclosed fee.

For an instant currency conversion quote, head over to the Wise homepage.

I’ve looked into many similar online currency specialists, but most of them require you to sign up with them before giving you a quote. I signed up with one, just wanting to see the rate and fee to plug into my thrilling comparison spreadsheet, and they wouldn’t stop ringing me and sending me emails!

5. How Do I Transfer Money Abroad with Wise?

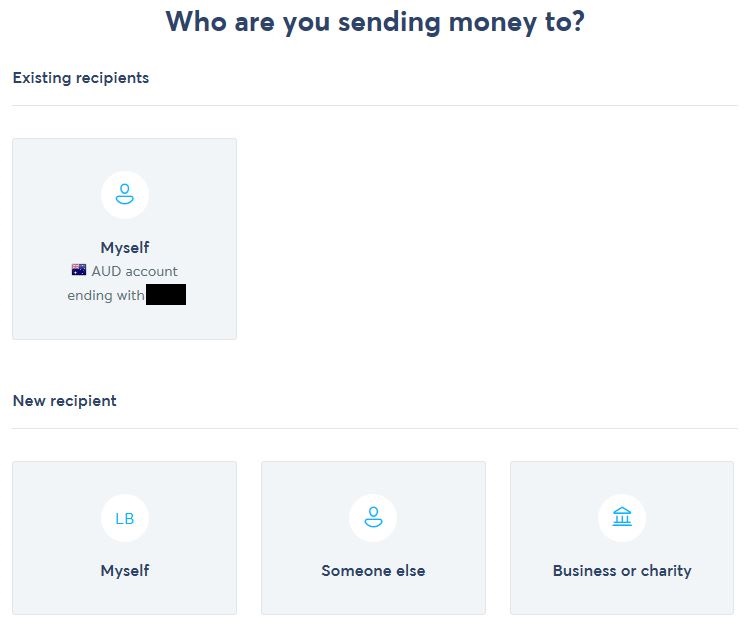

Wise is really easy to use. Once you’ve set up an account, you just enter the amount and type of currency you want to change, and how you want to pay (you can pay by credit or debit card, but I usually choose to transfer the money from my UK bank account to theirs as the fee is slightly less).

You then enter the details of the bank account you want the foreign currency to be paid into (your own or someone else’s), and then continue to pay. If you’re paying by bank transfer like I do, they’ll give you the details of their Wise account in the corresponding country, so you can make the online transfer straight from your account.

Each time you log in, you’ll see a list of all the previous transactions you’ve made. You can click on any of these and choose to repeat the transfer, rather than start from scratch. The recipient’s bank details are stored, so you don’t have to keep plugging them in. They’ll give you an instant quote using the current exchange rate.

The money usually arrives by the next day (or the same day, depending on the time), so it’s really fast!

I hope that’s helped you understand how currency transfers work, so that you can avoid being overcharged! Just click this link to get started with Wise.

Lisa Bull, founder of Dreaming of Down Under, has been living in Australia as a British expat since 2015. After travelling to every state and territory in Australia and living in Perth, Brisbane and Sydney, Lisa knows from first-hand experience the best destinations to visit in Australia and the best budget travel tips. Her guides on this blog have been read by over 700k readers and helped thousands of people achieve their dream of living in or travelling Australia.